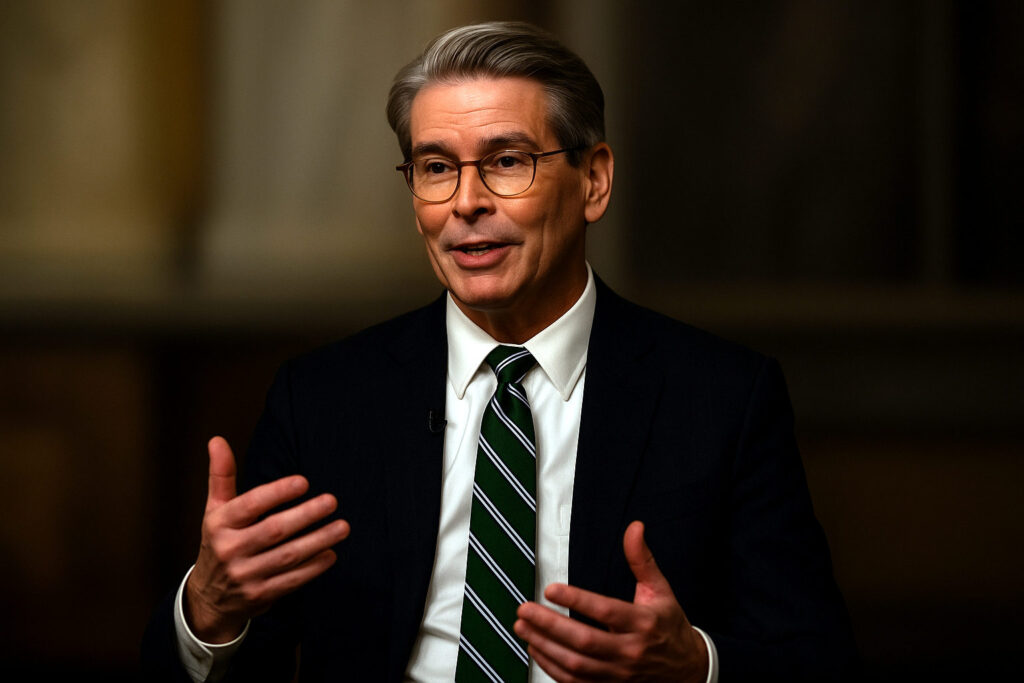

Scott Bessent didn’t exactly stumble into the role of Treasury Secretary. His path was paved with strategic bets and well-placed donations. He’s the kind of guy who knows where to put the money before anyone else even knows there’s a game on. When Trump came calling, it wasn’t because Bessent shared his ideology—it was because he shared his instinct for playing fast and loose with the rules when it suits the agenda.

Scott Bessent didn’t exactly stumble into the role of Treasury Secretary. His path was paved with strategic bets and well-placed donations. He’s the kind of guy who knows where to put the money before anyone else even knows there’s a game on. When Trump came calling, it wasn’t because Bessent shared his ideology—it was because he shared his instinct for playing fast and loose with the rules when it suits the agenda.

Born in Conway, South Carolina, Bessent grew up in a world where economic stability was a distant luxury. His father’s bankruptcy and his mother’s turbulent personal life—marked by five marriages, including two to Bessent’s father—should have been obstacles. For him, they were sparks. Barbara McLeod Bessent had taken over the family’s real estate business when Homer Bessent fell ill, an unusual move for a woman in that era. But financial mismanagement led to bankruptcy and the slow dismantling of their holdings. Bessent has recalled watching furniture being hauled out of their home—property that had been in the family for generations. That kind of loss carves its lessons deep, and Bessent seems to have learned them well.

He walked out of Yale with more than just a degree; he had a knack for precision timing. His time at Soros Fund Management was proof enough. Bessent helped orchestrate a billion-dollar bet against the British pound, a move that would become legend in financial circles. But let’s not kid ourselves—that bet wasn’t pure genius; it was a calculated risk at the right time, backed by Soros’s bankroll. Bessent didn’t carry that weight alone.

But Wall Street wasn’t enough. Bessent saw the political landscape shifting, and he moved with it. Bessent saw the political landscape shifting, and he moved with it. His net worth—hovering between $700 million and $1.3 billion—gave him the kind of leverage that opens doors. He wasn’t just betting on markets; he was betting on power. During Trump’s 2024 campaign, Bessent contributed over $1 million directly and raised millions more through fundraisers. In Palm Beach alone, he co-hosted an event that pulled in $50 million. This wasn’t philanthropy—it was strategic investment. Bessent knows that when you grease the wheels, you often get to drive. He bet on Trump in 2024, not just with cash but with his reputation. It wasn’t charity—it was an investment. A man like Bessent doesn’t switch teams without reason. His pivot to Republican circles was a calculated read on where power would settle in the coming years. But let’s be clear—he didn’t turn Republican out of ideology; he turned because the money and influence were stronger there. It’s not loyalty; it’s leverage.

As Treasury Secretary, Bessent’s maneuvers have been bold—or reckless, depending on your perspective.

His decision to halt operations at the Consumer Financial Protection Bureau (CFPB) wasn’t some ideological swing—it was a blatant power grab. As acting director, Bessent ordered a suspension of substantial CFPB operations, including halting enforcement actions, pausing active litigation decisions, and delaying the effective dates of pending regulations. The Dodd-Frank Act gives the CFPB director considerable authority, but the scale of Bessent’s actions raised questions about potential overreach. In summary, while Bessent, as acting director, possessed the authority to direct CFPB operations, the extent and breadth of the operational halt have raised questions about potential overreach and the balance of power within federal agencies. Strip away the guardrails, let capital flow, and see who can swim. Some called it reckless. Others call it blind arrogance. You don’t rip out the safety net unless you’re damn sure you won’t need it. Bessent acts like the markets are his plaything, and if they break, it’ll be someone else sweeping up the pieces.

The tariffs on China? They’re stamped with Trump’s signature, but Bessent’s fingerprints are all over them. Officially, these are Trump’s tariffs, announced with all the bluster you’d expect. But Bessent has been the one engineering the back-end, running negotiations, and pushing the strategy. At a recent cabinet meeting, Bessent openly praised Trump’s approach, calling it ‘strategic uncertainty.’ He even claimed it was creating leverage in trade talks, despite mounting costs on American importers. It’s not just economic posturing—it’s a reshuffling of the entire deck. But here’s the reality: this isn’t just bold—it’s dangerous. He’s not rethreading the global supply chain; he’s hacking at it with a blunt axe. There’s no real plan, just fire and fury with the hope that the ashes settle in his favor. If he’s right, it’ll redefine American economic independence. If he’s wrong, we’re looking at a crater where the economy used to be.

And then there’s his U.S. sovereign wealth fund proposal. That’s not just a big bet—it’s practically a dare. Modeled after global examples like Norway’s Government Pension Fund, Bessent’s vision is to leverage federal assets—gold reserves, real estate, even cryptocurrency—to create a multi-trillion-dollar investment fund controlled by the U.S. government. Trump signed the executive order in February, giving Bessent a 12-month deadline to get it rolling. The fund would be fed by monetizing federal holdings: 261.5 million troy ounces of gold worth $762.5 billion, vast real estate portfolios estimated at $1.3 trillion, and even 207,000 bitcoins valued at over $20 billion. His plan is to funnel that wealth into infrastructure, manufacturing, and tech projects aimed at reasserting American dominance in global markets. But here’s the rub: this isn’t Norway. America is politically fractured, and consolidating that kind of economic power under federal control is like building a dam on shifting sand—everything looks fine until it doesn’t, and when it gives way, there’s no stopping the flood. If it tips, the collapse will be unstoppable. Bessent seems to think he can manage those risks, but there’s a fine line between boldness and blind arrogance. If the foundation is unstable, it doesn’t matter how grand the structure is—it’s coming down, and fast.

His Congressional performances haven’t done him any favors either. For a man who’s supposedly in command of global markets, he sure fumbles when asked to explain his strategy. His vision for the sovereign wealth fund drew sharp criticism, with questions about transparency and federal overreach met with evasive, often fragmented responses. The same held true for his tariff strategy. Pressed on the long-term effects of his policies, Bessent deflected specifics, often circling back to generalized market projections without hard data. It wasn’t just political theater—it was the kind of dodging that makes you wonder if he even knows the answers.

Bessent’s style is raw, calculated, and ruthless—but it’s not invincible. He’s reshaping America’s economic engine with a wrench in one hand and a blowtorch in the other. It’s bold, it’s dangerous, and if it all comes crashing down, it won’t be Bessent left holding the bill.